Evidence-Based Investing

Evidence –based research directs us with focused strategies on the dimensions of higher expected returns. Traditional advisors often rely on forecasting techniques. Their next “can’t miss” investment advice is like looking for a needle in a haystack. We don’t believe in looking for needles in haystacks—we believe in owning the haystacks.

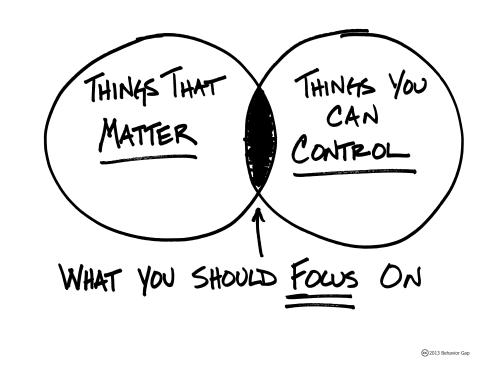

Decades of peer reviewed financial research demonstrates how investors can increase their expected returns and better achieve their goals when they focus on things they can control: minimizing costs, building a diversified portfolio, implementing effective tax strategies, and taking only those risks appropriate to their unique situations.

This approach—what we call Evidence-Based Investing— is at the heart of every client relationship and is the blueprint for your plan according to your needs and goals. It is the reason our clients are able to capture the returns that the markets provide, and it helps them build a more secure financial future for themselves and their families.

We provide confidence that comes from working with an experienced wealth advisor who values evidence over emotion, research over blind opinion.